Thor Doesn't Drive a Subaru

Welcome back, it’s Friday everybody. Less preamble for this one, you can find the first post here.

🗂️1/ Headline Roundup:

WSJ: Home Prices Hit a Record High

The basics:

- Prices keep going up: The national median existing-home price was $419,300 in May, a 5.8% increase vs. a year ago.

- It’s happening despite high interest rates: Even with the current mortgage interest rates sitting at about 7.5%, their highest since X date.

- Lawrence Yun, chief economist from National Association of Realtors’s take: “Somewhat of a strange phenomenon, where we have low home-sales activity yet prices are hitting record highs.” Affordability is a challenge.”

My two cents: I’m no expert but the relationship between supply and demand is certainly acting differently than I’d have expected. I’d have thought that the higher interest rates would’ve cooled off prices a bit more, but with so many people staying in their homes to avoid getting a higher mortgage rate on a new place, it’s constricting supply. Hard to buy a home right now for many.

WSJ: Skincare Company Galderma Sees Opportunity in ‘Ozempic Face’

The basics:

- Galderma, a Swiss skincare conglomerate best known in the US for a number of skincare pharmaceuticals as well as the over-the-counter face wash Cetaphil, thinks they’ve found a new market to tap: Ozempic users.

- Why? WSJ reports “some users looking gaunt and aged” after finishing treatment with a GLP-1 drug.

- Galderma’s CEO Flemming Ornskov: “If you have that kind of weight loss, not only do you have body transformation, but you also have facial transformation and they [users] are flocking to aesthetic treatments”. He went on to say that “Weight-loss products are rapidly changing aesthetics practices.”

- There are an estimated 3.5 million Americans using GLP-1 treatments.

My two cents: I used the term “externalities” twice in the first newsletter, thought I’d try to avoid it here, but this one’s too eye-catching to pass up. It really is remarkable, watching an innovation this impactful arrive at market, seeing it get rapid adoption, and then watching what the downstream impacts are. There are always domino effects. My gut instinct here is that it’s going to be a boon for the already-massive skincare industry, especially for injectable aesthetics like Botox. Action, meet equal and opposite reaction.

💵 2/ Cheap Strategy

Each week, I'll write up a short business strategy recommendation for a firm, brand, or startup I've got no connection to and very little experience with. I'll make two promises each time - it'll cost them nothing and may be worth the same.

✈️ This week: We're having a look at product placement in Hollywood films and coming up with a scenario of what it'd look like for one of these car companies to buck the trend and spend their ad dollars elsewhere.

📝Background: First, two unrelated articles:

Concave Brand Tracking: Top 100 Product Placement Brands in 2023 Movies

WSJ: No One Wants a New Car Now. Here’s Why.

💵My two cents: A firm called Concave Brand Tracking does an annual review of what brands received the most value from product placement in the top 50 movies of the year. They’ve just released 2023, and of the top 100 brands, 35 were car manufacturers. Your top 10 brands getting the most airtime in the top movies from 2023:

- Apple

- Chevrolet

- Ford

- Dodge

- Jeep

- BMW

- Mattel

- Dell

- Nike

- Porsche

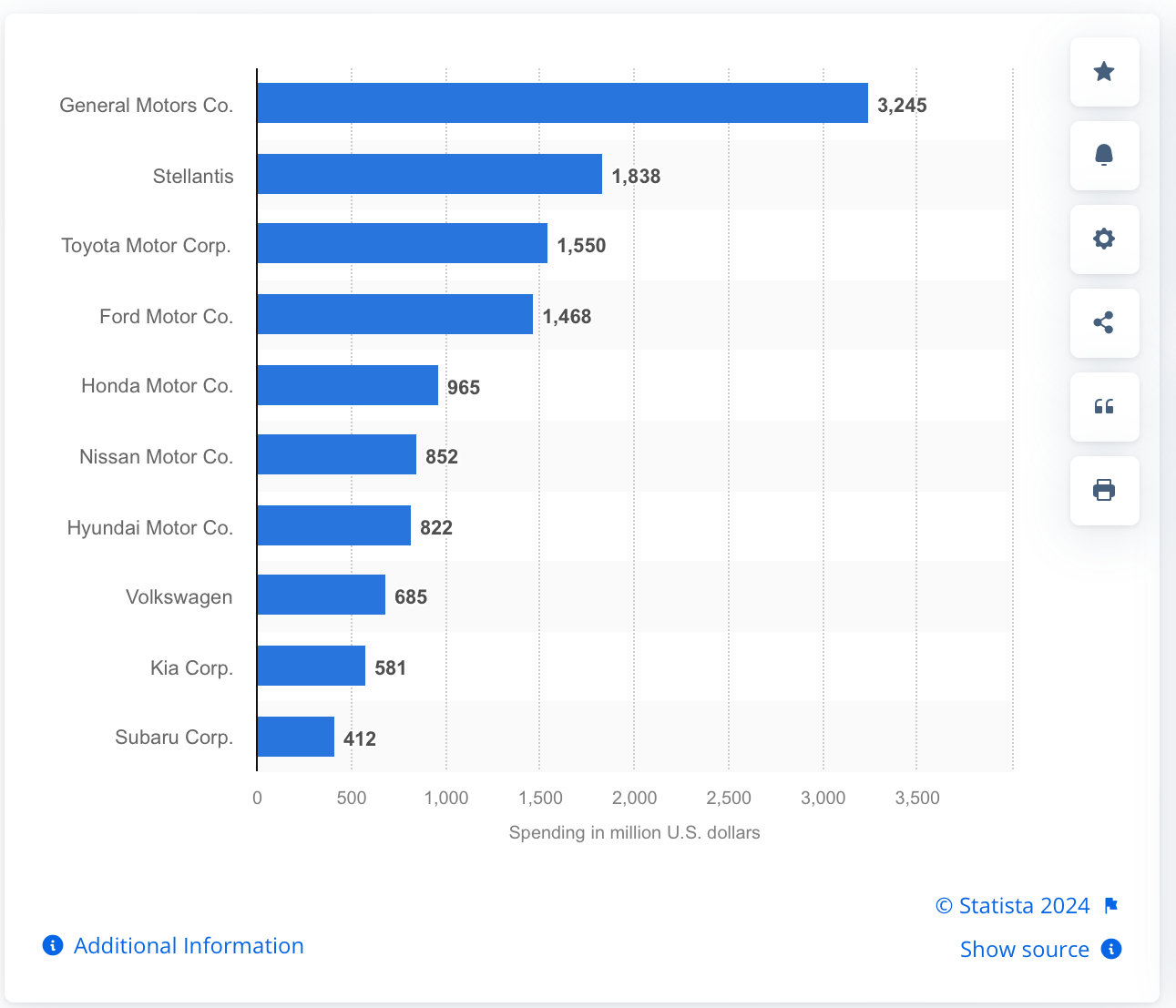

Six out of the top ten, thirty five out of the top 100. I'd wager it isn’t happening for free. Chevy presumably had to cut a check for that SS Blazer EV to show up in the Barbie movie. And whether it’s product placement or any other ad type, these car companies continue to invest heavily in putting their brands in front of us. Check out 2022’s annual ad spend by car manufacturer in millions, courtesy of Statista:

General Motors led the industry in ad spending, at just over $3.2BN in ads in 2022. They sold 2,274,088 cars in 2022, meaning that for every car purchased, on average $1400 was spent on advertising. It‘s a big expense!

I wonder what would happen if there was a CMO at one of these car companies that looked at this advertising expense and thought, this is a never-ending treadmill of hundreds of millions, if not billions of dollars going into advertising. Should we keep doing this? Would a car company ever be crazy enough to try bowing out of that race, and to play the game a little differently?

So, the case study: Under what conditions would it make sense for a major car manufacturer to meaningfully change what they do with their and budgets, and where might they reallocate it? What brand would be best positioned to do it?

Criteria:

- We want a brand that has something unique about their identity. I'd argue that this knocks out the brands like Honda or Kia, while those brands are solid, I view them as pretty interchangeable.

- We’re going to pick a challenger brand. My assumption is that the biggest brands with the largest market share are less likely to take a big risk, it’ll just feel like too much to lose. This means we'll skip Ford, GM, etc.

- We’re going to avoid luxury brands. Why? I think ads are going to be too intertwined with the ethos of brands like BMW or Mercedes - they're trying to feel aspirational.

My recommendation:

- I think a brand like Subaru could be the wildcard able to take this risk.

- They’re a challenger brand: In 2022, they were the 8th-best selling car manufacturer in the US.

- Their ad budget per car is half of GM’s, so advertising is inherently less a part of their go-to-market strategy.

- They likely invest minimally in harder-to-measure ad types like movie product placement, as they didn’t show up in the top 100 from CBT’s study. The Avengers never drove an Outback.

- They have a unique aspect to their brand identity: Safety. When you ask a friend who makes the safest cars, chances are good they’ll either say Volvo or Subaru. This is a part of their story.

How might they reinvest? Let’s assume Subaru wants to put the money into demand-driving tactics, rather than just pocketing the money.

- Reliability: They could try to find ways to reinvest the savings into a longer warranty. Part of how Hyundai was able to build a foothold in the US was their industry-leading warranty. They’re so confident in their cars, they’ll pay for maintenance for far longer than a GM or a Ford. If Subaru were willing to back their craftsmanship for longer than the industry average, it could build trust with car buyers.

- Price: They could funnel it back into price to make their cars whether it’s bigger promotional programs or interest rate buy-downs.

- Promotion: They could find strategic partnerships that help them move more cars, like an extra discount for Costco members or AARP members.

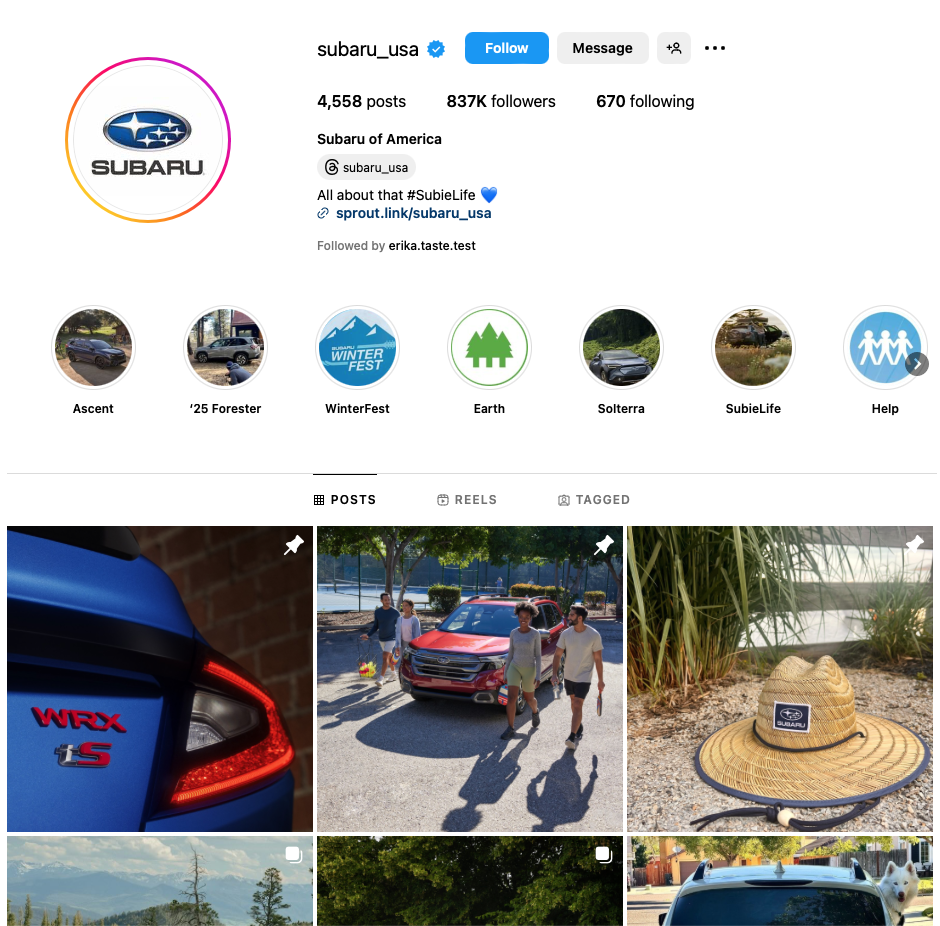

- Storytelling: Part of what makes a Subaru appealing is the connection their drivers have to these cars. I live in Seattle and can promise, this brand has loyalists. When I look at how Subaru presents their brand on Instagram, I see a real opportunity to recalibrate and make it about the why. Why do the hundreds of thousands of loyal drivers pick Subaru? Why not ask them and turn that a low-cost ad campaign?

Last word: How many car ads have you seen in your life? Hundreds, thousands? How many of them resonated with you? It's got to be a low number. I'd love to see a car company give this a shot. It wouldn't be without risk, but what a fascinating case study that'd be.

🍫 3/ An Andes Mint Before You Go

At Tex-Mex restaurants in Dallas, it's very common to be presented with one Andes Mint per person when paying your tab at the end of a meal. I think it's a lovely touch after I've housed five bowls of tortilla chips, and this is my attempt each week to round this thing out the same way.

My dad sent me one of the best ads I've seen in ages, wanted to share it with you.

It's for Visit Oslo, and I grinned from ear to ear as I was watching it. This is what I love about advertising.

Go get 'em, y'all. We'll do this again next Friday.

Want to get in touch?

- Email me at garrett@garrettking.com

- Follow Friday Business on Instagram

- Follow me on Instagram or Twitter

- Follow me on LinkedIn